Imagine this: You have saved up a significant amount and are ready to invest in real estate. But a crucial question arises—should you buy a plot of land and build your dream home, or should you invest in a ready-to-move-in flat?

Real estate investment is one of the most secure ways to build wealth, but the decision between plots and flats can be overwhelming. Each option has its own advantages and drawbacks, and making the right choice depends on various factors like budget, long-term goals, and personal preferences. This blog will compare and contrast plots and flats, highlighting the pros and cons of each to help you make an informed investment decision.

Understanding the Basics

What is a Plot?

A plot is a piece of land that can be used for various purposes, such as residential, commercial, or agricultural. Owners have full control over how the land is developed.

Advantages:

- Customization & Flexibility: You can design and construct your home as per your needs.

- Appreciation Potential: Land value typically appreciates faster, making it a lucrative investment.

- Sense of Ownership & Privacy: More control over your property with no shared walls.

- Lower Initial Investment (Potentially): In some locations, plots can be more affordable than ready flats.

- Potential for Future Development: You can expand, build additional floors, or sell parts of the land.

Disadvantages:

- Higher Risk & Responsibility: You must manage contractors, approvals, and construction yourself.

- Longer Timeframe: Building a house takes time compared to moving into a ready flat.

- Infrastructure Challenges: Basic amenities like water, electricity, and sewage may not be readily available.

- Legal & Regulatory Hurdles: Land ownership disputes and zoning laws can complicate the process.

- Maintenance Responsibility: The owner must take care of the plot entirely.

What is a Flat ?

A flat (or apartment) is a self-contained housing unit in a multi-story building. Flats come in different configurations like 1BHK, 2BHK, and 3BHK, with shared amenities and facilities.

Advantages:

- Ready to Move In: No waiting period, making it ideal for those seeking immediate occupancy.

- Amenities & Facilities: Flats often come with amenities like security, gyms, pools, and parks.

- Lower Maintenance (Potentially): Shared maintenance responsibilities in a housing society.

- Easier Financing: Banks provide home loans more readily for flats.

- Security & Community Living: Gated communities offer security and a sense of belonging.

Disadvantages:

- Limited Customization: Modifications and structural changes are restricted.

- Lower Appreciation (Potentially): Flats may not appreciate as quickly as plots.

- Maintenance Charges: Monthly fees can be a significant expense.

- Less Privacy: Proximity to neighbors can reduce personal space.

- Depreciation of Building: The value of the building structure depreciates over time.

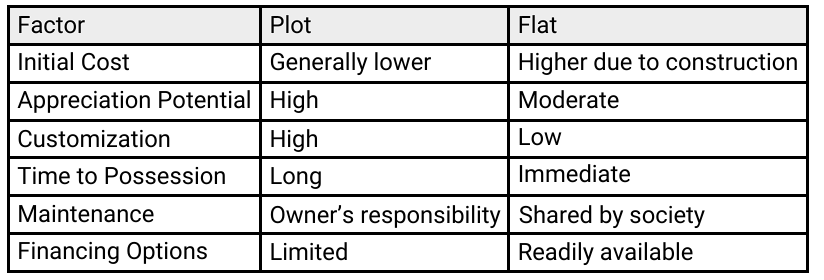

Factors to Consider When Choosing (Decision-Making Guide)

- Budget: Compare land purchase + construction costs vs. buying a flat.

- Investment Goals: Long-term appreciation vs. immediate occupancy.

- Lifestyle & Preferences: Do you prefer control or convenience?

- Location & Infrastructure: Availability of utilities, transport, and social infrastructure.

- Legal & Regulatory Aspects: Ensure clear land titles and necessary approvals.

- Time Horizon: Consider how long you plan to hold the property.

- Risk Tolerance: Assess comfort levels with land ownership risks.

Market Trends & Future Outlook

Real Estate Market Trends in India (2024 Data)

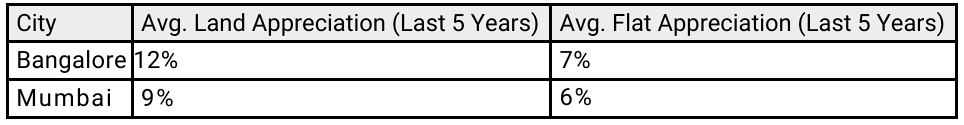

- Current Trends: Urban expansion and infrastructure development are boosting land appreciation.

- Future Growth: Flats in metropolitan areas provide rental income potential.

- Investment Prospects: Plots in emerging locations might yield higher returns over time.

- Demand & Supply: High demand for ready housing, but land is becoming scarcer and more valuable.

Case Study: Bangalore vs. Mumbai Real Estate

FAQs (Addressing Common Queries)

Q1: Which is a better investment, plot or flat?

It depends on your goals. Plots have better appreciation, while flats offer convenience and rental income.

Q2: What legal documents should I check for a plot?

Verify the title deed, encumbrance certificate, land records, and necessary approvals.

Q3: What are the typical costs associated with buying a flat?

Costs include down payment, stamp duty, registration fees, maintenance charges, and property tax.

Q4: How can I find a reputable builder for a plot?

Check the builder’s track record, previous projects, online reviews, and government approvals.

Q5: What are the tax implications of buying a plot versus a flat?

Flats offer tax benefits under home loan deductions, while land investments have different tax considerations.

Q6: Is it better to buy a plot in a developing area or a well-established location?

Developing areas offer higher appreciation potential, while established areas provide stability.

Q7: What should I keep in mind while negotiating the price of a flat?

Research market rates, check for hidden charges, and negotiate based on builder reputation.

Q8: How do I assess the appreciation potential of a plot?

Consider factors like location, infrastructure, upcoming developments, and market trends.

Q9: What common pitfalls should I avoid in real estate investment?

Avoid unclear land titles, rushed decisions, over-leveraging, and ignoring legal aspects.

Conclusion

Both plots and flats offer unique advantages and challenges. If you seek long-term appreciation and customization, investing in a plot might be the right choice. However, if you prefer convenience, security, and steady rental income, a flat could be the better option. Assess your financial position, lifestyle preferences, and market conditions before making your investment decision!